荷兰招聘

在本地或远程招聘之前,了解荷兰劳动法、成本和合规要素。

了解更多

如何通过签证担保在欧洲找到工作

探索签证选择、雇主期望和提示,以提高您在欧洲获得赞助工作的机会。

了解更多

_09.jpg)

_06.jpg)

_15.jpg)

_13.jpg)

_18.jpg)

_19.jpg)

_23.jpg)

_22.jpg)

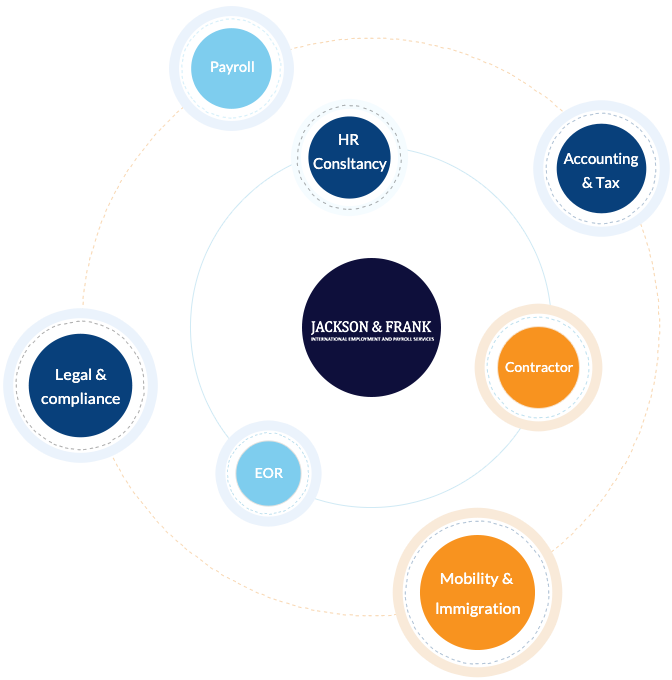

在 Jackson & Frank,我们不仅是服务提供商,更是您拓展国际业务过程中值得信赖的战略伙伴。我们的使命是简化并提升您的全球人力资源战略,帮助您自信而高效地在多个国家组建并管理卓越团队。

我们的服务包括:

为什么选择我们?

在 Jackson & Frank,我们不仅仅是服务提供者,更是帮助您业务在全球舞台上蓬勃发展的合作伙伴。让我们为您解决国际人力资源管理的复杂事务,您可以专注于最擅长的事情:发展您的业务。

固定期限合同(CDD - Contrat à durée déterminée) 是法国的一种雇佣合同形式,具有明确的开始和结束日期。固定期限合同受《劳动法典》(Code du travail)管辖,规定了雇主与雇员的权利与义务。

无固定期限合同(CDI - Contrat à durée indéterminée) 是法国最常见的雇佣合同形式,提供更高的稳定性以及如带薪休假等福利。

法国劳动法规定了全面的员工福利制度:

在法国,劳动力队伍主要有两种类型cadres (高管员工) and non-cadres (非管理层员工)。这种区分在工时,薪酬和福利方面有显著的意义。

Cadres(管理层/高管员工):

非Cadres(非管理层员工):

法定节假日:

|

o 元旦:1月1日,星期三 |

o 耶稣受难日:4月18日,星期五 |

|

o 复活节星期一:4月21日,星期一 |

o 劳动节:5月1日,星期四 |

|

o 欧洲胜利日:5月8日,星期四 o 圣灵降临节:6月8日,星期日 |

o 耶稣升天节:5月29日,星期四 o 圣灵降临节星期一:6月9日星期一 |

|

巴士底日:7月14日星期一 |

圣母升天节:8月15日星期五 |

|

万圣节:11月1日星期六 |

休战纪念日:11月11日,星期二 |

|

o 圣诞节:12月25日,星期四

|

o 圣斯蒂芬节:12月26日,星期五(仅限阿尔萨斯和摩泽尔省)

|

年假:

法国法律规定员工享有相对优厚的带薪年假。

病假:

在法国,员工有权享受病假,但需遵守一些具体规定:

产假:

法国为准妈妈提供慷慨的产假政策,以支持其在孕期和分娩后的恢复与育儿。

父亲陪产假:

在法国,父亲也享有完善的陪产假政策,以帮助他们与新生儿建立亲密关系。

法国在固定期限合同(CDD)和无限期合同(CDI)中均可设立试用期,但规定有所不同:

固定期限合同 (CDD):

无限期合同 (CDI):

在法国,终止劳动合同的通知期取决于多个因素,包括合同类型(CDI 或 CDD)、员工在公司的工龄,以及是否有适用的集体协议等:

固定期限合同 (CDD):

无限期合同 (CDI):

法国劳动法对加班工作进行了规范,以保障员工的福祉和公平的报酬。

加班定义:

任何每周工作时间超过法定35小时的部分即为加班。

加班补偿:

补休制度(代替加班费):

年度加班额度限制:

在法国,员工在工作中受伤或患职业病受到一套全面的职业风险社会保险体系的保障。

赔偿内容:

福利待遇:

责任分工:

第 1 步:合作协议/主服务协议(MSA)

第 2 步:任务说明书(采购订单)

第 3 步:雇佣协议/录用通知书

第 4 步:入职流程

我们将向候选人发送以下文件供其签署:

在收到上述文件后,我们将为员工办理官方注册。

第 5 步:移民流程(如适用)

离职流程可以分为以下四类:

在法国,雇主可以提前终止劳动合同(无论是永久合同CDI还是固定期限合同CDD),但相比员工主动离职,法律规定更为严格。

合法终止的依据:

解雇程序:

严格程序的例外情况:

解雇的替代方式:

分享您的雇佣需求,获取定制化方案。