荷兰招聘

在本地或远程招聘之前,了解荷兰劳动法、成本和合规要素。

了解更多

如何通过签证担保在欧洲找到工作

探索签证选择、雇主期望和提示,以提高您在欧洲获得赞助工作的机会。

了解更多

_09.jpg)

_06.jpg)

_15.jpg)

_13.jpg)

_18.jpg)

_19.jpg)

_23.jpg)

_22.jpg)

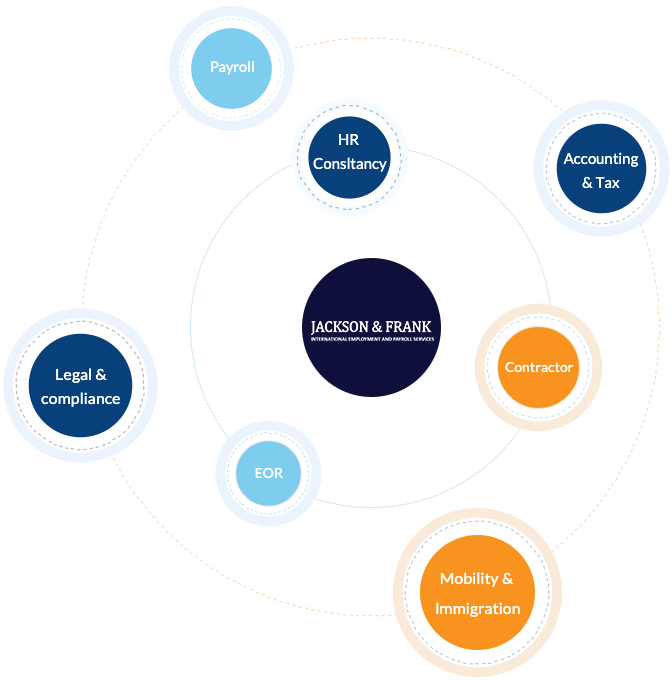

At Jackson & Frank, we go beyond traditional service provision to become your dedicated partner in scaling your business on an international stage. Our mission is to simplify and enhance your global HR strategy, enabling you to build and manage an exceptional team across diverse countries withease and confidence.

Smart Payroll: Tailored, compliant management adapting to local requirements.

Customized Packages: Competitive, culturally relevant packages to attract top talent.

Stay Legal Proactive management of ever-changing regulations.

Hiring Internationally: Seamless visa and immigration support.

Local Insight: Our experts in each country give you insider knowledge.

Run Smoothly: We take care of HR paperwork so you can focus on your business.

Grow Easily: Our services adapt as your company gets bigger.

With over 15+ years of industry experience, we have supported more than 100+ companies worldwide, consistently delivering exceptional service and strategic solutions tailored to our clients' needs.

We prioritize your needs with a responsive, client-focused approach, offering customized solutions that align with your specific goals and business objectives.

Our modular service model allows you to mix and match offerings across various locations, crafting a truly personalized global HR strategy that meets your unique requirements.

At Jackson & Frank, we’re not just providing a service – we’re building a partnership that helps your business thrive on a global scale. Let us handle the complexities of international HR management so you can concentrate on what you do best: growing your business.

There are mainly two types of contracts in the Netherlands

The contract is concluded for a definite period and terminates automatically after defined time period. Labour law is the same for both fixed term and permanent employees. A fixed-term employment contract will automatically convert into an open-ended(permanent) employment contract if either of the following occurs:

A chain of temporary employment contract covers 36 months or more.

A chain of three fixed-term employment contracts is continued.

The contract is concluded for indefinite period.

In both the cases mentioned above, the following points should be specified in the employment agreement.

The parties' names and addresses, the location of the work to be done, the position, and a job description.

The date of hiring.

If the job contract is for a set amount of time, the time frame.

The annual leave entitlements or the formula used to determine the annual leave allowance.

The length of the notice periods that must be observed by the parties or how these periods are determined.

The salary and the frequency of payments.

The normal number of hours worked each day or each week.

The collective bargaining agreement, if any.

Dutch employee benefits are a two-pronged approach: mandatory benefits by law and additional benefits offered by employers. Here's a breakdown of both:

Minimum Wage and Maximum Working Hours: The Netherlands has a legal minimum wage that's adjusted twice a year. There's also a limit on the number of working hours per week.

Paid Time Off: All employees are entitled to a minimum of 20 paid vacation days per year, plus an additional holiday allowance (vakantiegeld) of 8% of their gross annual salary.

Sick Leave: Employees are entitled to paid sick leave for a specific period, with a percentage of their salary covered depending on the duration of illness.

Health Insurance: Everyone in the Netherlands must have health insurance, with a portion of the premium paid by the employer.

Pension: Employers contribute to a pension plan for their employees.

Social Security Contributions: Both employers and employees contribute to social security, providing benefits like unemployment and disability insurance.

Travel Expenses: Reimbursement for commuting costs like mileage allowance, company car, or public transport passes.

Flexible Work Arrangements: Options for remote work, flexible hours, or compressed workweeks.

Company Perks: These can include gym memberships, discounts on products or services, or social events.

New Year's Day: Wednesday, January 1

Good Friday: Friday, April 18

Easter Sunday: Sunday, April 20

Easter Monday: Monday, April 21

King's Day: Saturday, April 26 (celebrated a day earlier in 2025, as April 27 falls on a Sunday)

Liberation Day: Monday, May 5

Ascension Day: Thursday, May 29

Whit Sunday (Pentecost): Sunday, June 8

Whit Monday: Monday, June 9

Christmas Day: Thursday, December 25

Boxing Day: Friday, December 26

Employees in the Netherlands are legally entitled to a minimum of 20 days (four weeks) of paid annual leave per year.

This is calculated as four times the number of hours worked per week.

For example, a full-time employee working 40 hours a week would be entitled to 160 hours (4 x 40) of annual leave, which translates to 20 days.

A part-timeemployee working 24 hours a week would be entitled to 96 hours (4 x 24) of annual leave, which translates to 12 days.

In the case of interim commencement or termination of the employment, the number of holidays is determined pro rata with the number of months the employee is determined to have been employed.

Holidays should be used during the contract period.

A maximum of 5 holidays can be transferred to the next year.

Not taken holidays will expire 6 months after the year they have been built up.

The Netherlands has a comprehensive sick leave system that provides financial support to employees who fall ill.

Employees in the Netherlands are entitled to receive at least 70% of their wages if they become ill and are unable to work.

This applies for a maximum period of two years from the first day of illness.

There's a difference in who pays based on your employment type:

Employer: Employer is responsible for paying 70% of your wages for the first two years of illness for permanent and temporary contracts.

UWV (Employee Insurance Agency): If the employees have a temporary contract or are receiving unemployment benefits, UWV will take over the payments after any waiting period required by your specific situation.

It's crucial to inform the employer as soon as possible if employee is unable to work due to illness.

The specific process for reporting may vary by company, but it often involves calling, messaging, or emailing manager and HR.

Employer may request a doctor's note depending on the duration of your illness or the company's sick leave policy.

The two-year paid sick leave applies even to fixed-term contracts. However, the sick leave pay won't extend beyond the contract end date.

The Netherlands offers generous maternity leave policies to support mothers after childbirth. Pregnant employees are entitled to a total of 16 weeks of leave, divided into two parts:

Pregnancy leave: This is 6 weeks before the expected due date (can be reduced to 4 weeks if preferred).

Maternity leave: This is at least 10 weeks taken after childbirth.

If the baby is born earlier than expected, the total 16 weeks still applies, but it starts from the day after birth.

In some cases, maternity leave can be longer:

Multiple births: For twins or multiple births, mothers are entitled to 20 weeks of leave (6 -8 weeks pregnancy leave + 10 weeks maternity leave).

Unforeseen circumstances: If the newborn requires extended hospitalization after birth, maternity leave may be extended until the baby and mother are discharged together.

Mothers receive a benefit equal to 70% of their daily wage, with a maximum daily amount set by the government.

This benefit is paid by the Employee Insurance Agency (UWV) in the Netherlands.

Mothers can decide when to take their pregnancy leave within the allowed timeframe.

It's advisable to discuss your preferred leave schedule with your employer well in advance.

Fathers or partners in the Netherlands are entitled to paternity leave to bond with their newborn child. The Netherlands offers two types of leave for fathers/partners:

Partner leave (geboorteverlof): This is 1 week of paid leave within the first 4 weeks after the birth of the child.

Employer must pay you your full salary during this time.

Employee typically need to apply for this leavein writing at least 2 months beforetheexpected due date.

Additional paternity leave (aanvullend geboorteverlof): This is unpaid leave for up to an additional 5 weeks.

It can be spread out however you like within the first 6 months after the birth.

Employee must request this leave 4 weeks in advance and can only take it after using 1 week of paid partner leave.

The Netherlands allows for a probation period in employment agreements, but there are strict regulations on its duration depending on the type of contract:

Indefinite term contracts (permanent contracts): The maximum probation period is two months.

Fixed-term contracts:

Contracts lasting six months or less: No probation period is allowed.

Contracts lasting more than six months but less than two years: The maximum probation period is one month.

Contracts lasting two years or more: The maximum probation period is two months, similar to permanent contracts.

The probation period must be agreed upon in writing in the employment agreement. A verbal agreement for a probationary period is not valid.

During the probation period, both the employer and the employee can terminate the contract without notice or reason. However, termination cannot be discriminatory.

The notice period for terminating an employment agreement in the Netherlands depends on thetype of contract and the length of employment for permanent contracts.

The statutory minimum notice period for an employee is one month. This applies to both permanent and fixed-term contracts.

However, the employment contract can specify a longer notice period, up to a maximum of six months. This has to be explicitly agreed upon in writing.

For employers, the notice period depends on the duration of the employee's permanent contract:

Less than five years: One month

Five to ten years: Two months

More than ten years: Notice period increases by one month for every additional five years of service, up to a maximum of four months.

The notice period starts on the first day of the following month after the termination notice is given (in writing).

Failure to give proper notice: If either party fails to provide the required notice period, they may be liable to pay compensation to the other party.

In the Netherlands, severance pay is called a transition payment (transitievergoeding). It's intended to help you financially while you search for a new job.

Eligibility: Employees get a transition payment if the employer fires the employee, or if employer don't extend your fixed-term contract (unless it's your fault). There are some exceptions, but generally, it's triggered by an employer-initiated termination.

Amount: The payment is based on the salary and years of service.

It's typically 1/3 of your gross monthly salary for each year you worked for the company.

Cap: There's a cap on the total amount employee can receive. It's the higher of either €89,000 gross or your entire annual salary.

If employee and employer agree to terminate the contract amicably, employee typically won't get the transition payment. Negotiations might involve a higher severance amount in the agreement.

If employer fired employee unfairly, employee might be eligible for a "fair payment" claim (billijke vergoeding) on top of the transition payment.

A typical Dutch workweek is 40 hours.

There are legal limits on working hours:

No more than 12 hours per day.

Maximum of 60 hours per week.

Over a four-week period, the average shouldn't exceed 55 hours per week.

Over a 16-week period, the average shouldn't exceed 48 hours per week.

Unlike some countries, Dutch law doesn't dictate specific overtime pay rates.

Common options include:

Extra pay: Typically ranges from 50% to 100% of the employee's regular wage.

Time off in lieu: Employees can take extra paid time off instead of receiving cash payment.

Employees who work without their supervisor's instruction.

Overtime of less than one hour after standard working hours.

Employees classified in a higher salary scale (usually management, scale 11 or higher) - overtime might be considered part of their salary.

It's important for employees to accurately record their overtime hours to ensure proper compensation.

If employee experience a work injury:

Report it immediately to theemployer. This is crucial for documentation and receiving support.

Serious accidents (hospitalization, permanent injury, or fatality):

Employer must report this to the Netherlands Labour Authority (NLA).

Employee can also report it.

Income Continuance:

Employer pays at least 70% of the salary if employee can't work due to the injury, for up to two years. (Similar to sick pay)

This is covered by the Wet ziekteverzuim (Work Incapacity Benefit Act).

Employee Insurance Agency (UWV):

If employee is still unable to work after two years, UWV might provide benefits based on situation.

Employer Liability: Employer might be entitled to more if employer's negligence caused the injury, including:

Medical expenses related to the injury

Loss of future income due to disability

Compensation for pain and suffering (fixed amount based on severity)

We will share Intake Sheet to collect company information.

Based on the data provided in intake sheet, we will prepare Cooperation Agreement/MSA for review and signature.

We will prepare Assignment Specification based on the candidate information provided in the Intake Sheet for review and signature.

Once the AS is signed, we will prepare draft Employment Agreement for review.

After the approval, we will share the final Employment Agreement to the candidate for review and signature.

We will share the final copy of the signed EA to all the parties.

We will share the following documents with the candidates for signature

Personal Questionnaire Form

Bank Account details form (for payment purposes)

Medical examination form and certificate

Health Insurance documents (Health ID Card)

Once the documents are received, we will register the employee with authorities.

Our Finance team will share the invoice for immigration process if required.

Once the immigration invoice is cleared, we will start the onboarding process.

Intake Sheet (Onboarding Sheet)

Passport Copy

Residence permit/ Work permit (if any)

Updated CV

Higher Degree Certificates.

Social Security number (if available)

Antecedent Certificate (if Immigration is required)

Payroll Tax form

Bank Account Form

Termination of a fixed term contract without extension.

Premature termination by mutual consent.

Premature termination by the employee.

Premature termination by the employer.

Generally, fixed-term contracts end automatically upon theexpiry dateor completion of the specific ask as outlined in the contract.

If the employer decides not to extend a fixed-term contract of at least 6 months, employers are legally required to inform this decision at least one month before the end date.

Failing to do so might entitle you to one month's salary as compensation.

If the employee earned any holiday pay during their employment but did not take all their entitled vacation days, they are compensated financially for the unused days.

This happens because of resignation or both the parties decide to terminate the contract mutually. In any case the standard notice period should be respected.

Termination Agreement (beëindigingsovereenkomst): This is a written agreement you and your employer sign, formally ending the contract before its pre-determined date.

No Fault Necessary: Unlike some situations, there's no requirement for fault on either side to initiate a termination by mutual consent.

Severance Pay: Employee might be entitled to a severance package that could be higher than the transition payment.

Notice Period: The agreement can waive or modify the usual notice period

Final pay should include salary for the period worked during the final pay cycle, along with any accrued but unused vacation pay.

If the employee earned any holiday pay during their employment but did not take all their entitled vacation days, they are compensated financially for the unused days.

An employee in the Netherlands can prematurely terminate their employment agreement, but there are important considerations and potential consequences to be aware of.

Unlike some countries, the Netherlands has mandatory notice periods that both employers and employees must adhere to when terminating a contract. The notice period for an employee resigning depends on duration of the employment

Notice period based on employment duration:

Less than 5 years : 1 month

Between 5 and 10 years : 2 months

Between 10 and 15 years : 3 months

More than 15 years : 4 months

Statutory Minimum: There's a legal minimum notice period of one month, which applies if the employment contract doesn't specify a different period.

In the Netherlands, there are strict rules around premature termination of a fixed-term or permanent employment agreement by the employer. Here's a breakdown of the situations:

General Rule: Fixed-term contracts automatically end on the pre-determined date in the contract. No notice period is required from either party.

Employer Obligation (6+ Months): If your employer decides not to extend a fixed-term contract lasting at least 6 months, employer must inform you at least one month before the end date. Failing to do so might entitle you to compensation.

Notice Period: Employers must follow a minimum notice period for termination, based on the employment duration.

Grounds for Termination: There must be a valid reason for termination, such as:

Redundancy: Due to company restructuring or economic downturn.

Poor Performance: Documented performance issues after following improvement plans.

Misconduct: Serious employee transgressions that violate the employment contract.

If employee believe the termination is unfair or without proper notice, employee can contest it.

Employee might be entitled to:

Severance Pay (Transition Payment): Unless employee seriously breached the contract.

Continuation of Salary: During the legal notice period.

Compensation: For lost wages if the termination is deemed unlawful.

分享您的雇佣需求,获取定制化方案。